“Everything you wanted to know about Gold and Silver as Precious Metals but had no one to ask…”

There are many types of items of value and many justifications as to what makes that item valuable. Thoughts on the fundamental value of rare or Precious Metals, diamonds… to “art work,” Crypto Currencies (aka ‘Bitcoin) and other investments abound.

This essay is edited by an Old School Person (Jack Lawson) as written by a qualified Old School Precious Metals and Fundamental Tangible Investments Dealer (Clay Olson-Contributing Author). We are not dinosaurs nor do we have our “heads buried in the sand.”

To the contrary, we have our “heads on a swivel” as they say in Special Operations ready for anything thrown at us from any direction. Well, at least Clay has his on a swivel regarding Tangible Investments… as he’s experienced about every type of Tangible Investment under the sun in his time.

Experience always outperforms ideas and new enthusiasm. And Clay has 40 years of his own experience plus being born into a family that’s been eating, sleeping and breathing Precious Metals and investments for decades even before he was a twinkle in his Daddy’s eye. Still, he’s always evaluating sound new investments. The trouble is… there is very little in new Tangible Investments.

History shows that by and large those who “Err on the side of caution” regarding financial issues… usually prevail… and don’t lose their investments.

Maybe a few ‘miss the boat’ on opportunities, but we also realize our limitations and who we are, as you should… common people… not the Jeff Bezos or Elon Musk type who live in a different world than us.

Especially when it comes to the Mother of All Issues that affects most people… financial security. Like Clint Eastwood said in the movie “Dirty Harry” “…a man has got to know his limitations!”

You might say to us… “You old fools… you have to change with the times!” Realize one thing… like Laws of Physics do not change… the Laws of Finance and Investments do not change… they are finite. Face it… you are not as smart or devious as some people who stay up until 3 AM to concoct these investment vehicles and schemes… through which they make fortunes… and you lose yours.

Real Estate is not included in this essay evaluation of worth. That would take books to explain and largely determined on the “By guess and by golly” principle. I know people who have lost ten million… to hundreds of millions of dollars in Las Vegas real estate holdings in the 2008 housing collapse that hit the United States… Las Vegas, Phoenix and Sacramento the hardest.

I look in the mirror every morning while shaving and see one of them who lost the lower millions amount. A better investment would have been buying HO Scale Model railroad trains. HO Scale Model trains are two to five times the value now than back then… even though they have little real intrinsic value, unlike grid down useable items.

Art Work

Let’s get one ‘investment’ out of the way. Art Work, history has determined, is diametrically the opposite of winning the musical chairs game. With the musical chairs game, when the music stops, hopefully you have a chair to sit in, or you lose the musical chairs game. In comparison to, when the real-life disaster of financial chaos or disruption comes, it is best to be the opposite of the musical chairs game and “not to have a chair” …that meaning not being the owner of Art Work… as you lose with them as an investment.

Art Work, by historical record, goes by “The Greater Fool Theory” …that there is always a Greater Fool out there ready to pay the unfounded and ridiculous price that the former Greater Fool who owns Art Work is selling it for. And, that the Greater Fool to hold it when financial chaos or disruption comes… loses his money.

I recently told a family member obsessed with investment in Art Work, because of the increasing value of them and what he considers “rock bottom prices” on some he speculates will go up in price like a rocket blasting off…

“Buy edible and combustible Art Work, at least that may keep you fed when the value of it is the caloric food content it has or the heat you can get off it for warmth, boiling water and cooking from it… when it burns.”

Art Work’s value, with a few exceptions, has always been that in times of abundance and expansion of the monetary system through unjustifiable fiat money growth (see the definition), the price of Art Work is driven to its own unjustifiable value by abnormal economic mechanisms and illogical investment thought. If you think I am wrong… good luck to you!

Dictionary Definition

fiat

noun

fi·at \ ˈfē-ət

Definition of fiat: In the case of money or other financial instruments… that which is created by an authoritative decree, sanction, or order. Money made out of thin air by a decree based on Babylonian Money Magic Principles, an arbitrary decree or pronouncement, especially by a person or group of persons having absolute authority to enforce it such as… “The king ruled by fiat.” Fiat money is usually a government-issued currency that is not backed by a physical commodity, such as Gold, Silver or other items of intrinsic value, but rather by the government that issued it. Thus, the American Dollar is backed only by the FIAT statement of the Federal Reserve Bank… “Backed by the full faith and credit of the United States Government.” That is the value that backs the American Dollar… those words… only.

Origin: From Latin ‘fiat…’ “let it be done” (used in the opening of 1630’s Medieval Latin proclamations and commands), of fieri “be done, become, come into existence,” used as passive of facere “to make, do.” Meaning “a decree, command, order.”

Crypto Currencies

This form of investment should be next to the word ‘Fiat’ or ‘Ponzi Scheme’ in the dictionary as a definition example. Crypto currencies are the ultimate in value by decree. They are only as worthy of value as are the magnetic ones and zeros of the binary digital world (the basic calculation and information coding system of all computers) and ‘Block Chain Economics’ and expressed in the unit ‘bitcoin’ or other.

Crypto Currency reminds me of a 1960s futuristic movie, where in the future, money is spoken of not as Dollars, Pounds, Francs, Marks, Krona, Yuan or Yen… but units called ‘credits.’ Definitely hot air value… which Crypto Currencies are helping to move us towards… a cashless digital ‘credit’ currency. Currency will be nothing of form you can hold in your hands… except computer entry displays or paper print outs.

A more dangerous aspect of these digital currencies is that they can be used to control where, how and when you spend them… also known as… controlling you. What is further alarming is that they can be taken from you in a computer instant… as punishment for you being a defiant and naughty citizen.

A Definition of Block Chain Economics from Wikipedia (Wikipedia is a Leftist controlled and edited information source, but since this issue isn’t really political and they have no reason at this time to twist the information to fit Leftist agendas… I’ll use their definition)…

“A blockchain is a growing list of records, called blocks, that are linked together using cryptography. Each block contains a cryptographic hash of the previous block, a timestamp, and transaction data. The timestamp proves that the transaction data existed when the block was published in order to get into its hash”

If that convinces you of fundamental value… then good luck. ‘Block Chain security,’ verification puzzles, government involvement, ‘peer to peer’ control, or not… both Clay and I believe Crypto Currencies are nothing more than a Ponzi scheme… not controlled by one person like the late Bernie Madoff, but by all holders of Crypto Currency. In our opinion, that makes Crypto Currencies a mob controlled and a decentralized Ponzi/Madoff scheme.

Information on the internet can evaporate like the clouds on a hot Summer’s day and these different crypto value systems have had massive hacking and theft of billions of ‘bitcoins.’

Plus, new ‘government’ involvement should alone warn you of the dangers of Crypto Currency. They are getting into these currencies, not for the benefit of the currency or holder, but for their eventual control, regulation and spending.

Secure? I don’t think so. These massive thefts have generally been glossed over in the scramble of governments and banking systems to establish their creation and control of Crypto Currencies. And then just like governments and Central Banks have done with paper currencies… they can dissolve these or let Crypto Currencies take the path of massive deflation. What are you going to do then… storm the Crypto Currency ‘bank’ computer with the family shotgun and blow holes in it if it doesn’t hand over your magnetic ones and zeros?

My friend Vito P., extremely well-to-do financial wizard extraordinaire, retired Army Colonel and attorney, who has lived in the Washington D.C. swamp for decades and was one of the head executives of a former President’s business group said to me… “You’d never find a moment in my life where I’d own ten-cents worth of Crypto Currency!”

I had the feeling from the tone of his voice that he’d rather stand on the corner of a busy street with his pants down first when I asked him his opinion of Crypto Currencies and whether he’d own them. This guy knows virtually all of the major players in D.C., many on first name basis. He is a realist who understands how government and finance works.

The latest theft of $320,000,000 dollars in Crypto Currency has been “restored” according to those involved with the maintenance and security of this particular Crypto Currency system. With what!? Real money…? No, just more magnetic ones and zeros of the digital binary world … money created out of thin air and electrons.

If that doesn’t convince you of the worthlessness of Crypto Currency as a form of fundamental value… go back to reading your Captain Marvel Comic Books as you await the Good Captain’s appearance to straighten out the injustices of the world. At least with fiat paper money and financial instruments in a worst-case scenario you can hold the value in your hand… that of the paper. The worth of that may be dubious, but it can be used as wallpaper or burned for warmth when it finally collapses.

If you think Crypto Currencies are a real investment or THE investment, you’d better read this first…

https://jacobinmag.com/2022/01/cryptocurrency-scam-blockchain-bitcoin-economy-decentralization

So, if you heed this warning and do what a logical person would do… cash out all or most of your Crypto Currencies… write out an I.O.U. to Clay Olson and Jack Lawson for 10% of the amount you cashed out, then out of honesty and decency, pay Clay and me when Crypto Currencies show their real value… when they evaporate into the same thin air that they were created out of. When they are as worthless in reality as they are in the illusion of present time.

What is covered in this essay is Gold and Silver, ‘Old School’ rare metals that most people hold as investment hedge or safeguard against fiat ‘currencies’ and other fiat financial instruments. Palladium and Platinum are two other Precious Metals that people hold in physical form… that you have to investigate for yourself.

Also, Grid Down items that we only touch on here maintain or increase in value…Food, ammunition, medicines, finger nail clippers and many items that there would be a temporary absence of or that would soon disappear from society, may be items of value. None of these have lost value in the last 100 years… quite the opposite… they have gone up.

Intangible Values that are worth something

Never forget the value of skills to your “tribe,’ people, Neighborhood Protection PlanTM Group Members or area… such as people experienced in, and who can adapt quickly to Grid Down basic conditions… (an environment of no or little electricity, no testing methods, shortages of food, water and medicines, heat or cold, and an environment of poor cleanliness and sanitation) …providing skills such as…

- Medical professionals skilled in blood transfer, poison treatment, rehydration, surgery and triage medicine.

- Shoe repair, cobbler.

- Metal work blacksmithing.

- Expert mechanics.

- Hunters who can bleed, skin and process an animal.

- Fishermen.

- Gardeners who are experienced.

- Animal husbandry (those who know from experience how to raise hogs, cattle, sheep, chickens, milk cows).

- People who know how to preserve perishable foods Grid Down.

- Chefs who can cook in Grid Down conditions.

- Scroungers (People who can find anything).

- Masons and concrete experts, carpenters and construction people versed in Medieval construction techniques… see…

https://civildefensemanual.com/protecting-your-neighborhood-insights-from-medieval-fortresses/

- The “project and people organizer” leadership person.

- Experts in wild edibles of your area.

- Experts in tree knowledge and lumber making.

- Balanced, knowledgeable, tolerant and level headed leaders.

- Military leadership in tactics and command.

- Long range firearms marksmen experts.

- Teachers in contact martial arts and knife, hatchet, machete fighting.

- Experts in bow & arrow and or crossbows.

- Seamstresses, soap makers, weavers and string/rope makers.

- Communications and electronics repair people.

- People qualified for children’s care, education and activities.

- Chemists, especially with knowledge of medicines, mortar making, gun powder formulation and water treatment.

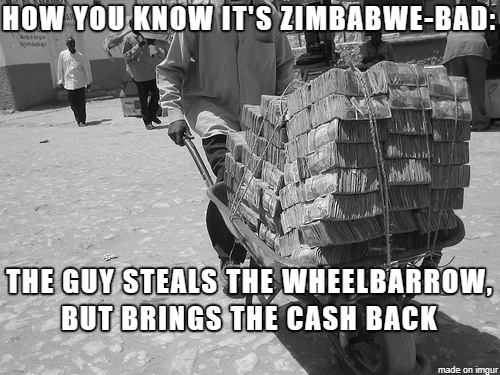

Hyperinflation

Here we will cover the normal economic ups and downs, or cycles of economics, not fully including an issue that is now rearing its ugly head and will drive most of the words we write here off the paper and your computer screen as meaningless…

Here we will cover the normal economic ups and downs, or cycles of economics, not fully including an issue that is now rearing its ugly head and will drive most of the words we write here off the paper and your computer screen as meaningless…

…the total destruction of financial being and worth through hyperinflation.

Read…

https://civildefensemanual.com/warning-posted-by-capitalist-eric/

Measuring Worth

Go to this website… https://www.measuringworth.com/datasets/gold/result.php

Lawrence H. Officer and Samuel H. Williamson post “The Price of Gold, year 1257 A.D. to Present” on the website Measuring Worth, 2022. (Trivia… Anno Domini doesn’t mean ‘After Death’ but means “In the year of our Lord,” being the year that Jesus Christ was born and all years thereafter to the Second Coming). I am a financial contributor to this website and this excerpt is from that website…

Measuring Worth Is a Complicated Question

Intrinsic things are priceless: the love of your life, a beautiful sunset, or freedom. There is no objective way to measure these, nor should there be.

The worth of monetary transactions is also difficult to measure. While a price, wage, or other kind of transaction can be recorded at a precise point in time, the worth of the amount must be interpreted. The father of economics, Adam Smith, discussed this very question in one of the most important books in economics, The Wealth of Nations (1776):

“The real price of everything, what everything really costs to the man who wants to acquire it, is the toil and trouble of acquiring it… But though labour be the real measure of the exchangeable value of all commodities, it is not that by which their value is commonly estimated… Every commodity, besides, is more frequently exchanged for, and thereby compared with, other commodities than with labour.”

One can imagine that a hamburger of the same price is “worth” more to a starving homeless person than to a very wealthy one. An allowance of five pennies a week was worth more to a child in 1902 than it is to a child today.

Gold has always been a fascination to both scholars and the public at large, partly because of the use of Gold as coined money, in jewelry, and in the arts, partly because of Gold’s high value/weight ratio.

It is this high ratio, that is, the price of Gold, that underlies the utility of Gold, rather than other commodities or metals, for these purposes, although the famed “glitter” (appearance) of Gold also plays a role.

From https://raconteurreport.blogspot.com/2022/01/economics-101-inflation.html

Huge factors convening towards disaster

The United States Military is being gutted as a competent fighting force, compared to what it was, as I write this… and the people in Washington who are supposed to “serve the American people” in most cases care only how much money they can get from the Chinese and financial interests from concealed transactions that continue to do just the opposite of serving… transactions that subjugate and destroy what’s left of the America they’re supposed to serve and protect.

They serve only themselves regardless of which political party they claim to align with. They have sold their souls and we will have to pay for it… as it is nearing midnight on the proverbial clock of events. What isn’t being ruined by these disloyal people will be destroyed by further issues resulting from the Covid hysteria and such rubbish… such as massive borrowing and irreparable damage to businesses.

They serve only themselves regardless of which political party they claim to align with. They have sold their souls and we will have to pay for it… as it is nearing midnight on the proverbial clock of events. What isn’t being ruined by these disloyal people will be destroyed by further issues resulting from the Covid hysteria and such rubbish… such as massive borrowing and irreparable damage to businesses.

The few politicians and prominent people I listen to… such as American Heroes Mike Lindell of MyPillow.com and Senator Rand Paul… and forgive me if you are one of them, but not mentioned… are good people. Most of the remaining people and politicians are no more than self-serving phony’s and traitors to all but their own interests.

If I sound sarcastic and cynical with those statements… keep watching your Mainstream News Media and believing that your elected representatives mean what they say… and good luck to you!

A book that will open your eyes is written by Bob Livingston. Get a copy of his book the “Ultimate Hyperinflation Manual” at https://www.boblivingstonletter.com/ You will find the information of this Author Genius cuts through all the deception of what you live in… and will tell you the bare bones truth of finances, the economy and our government… all driving America towards collapse.

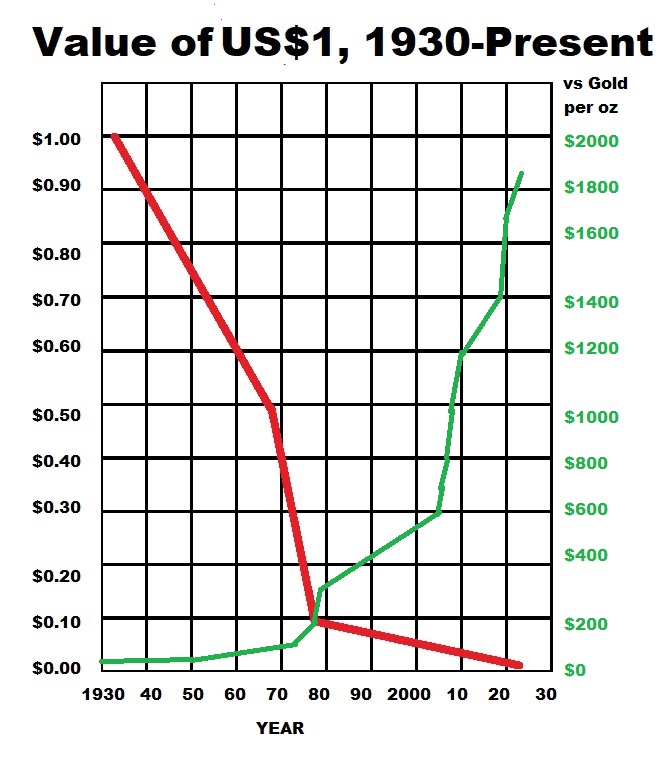

When will this collapse happen? That’s the big question

It has already begun. American currency, the dollar, is now paper not much different than what can be printed from your computer. There is nothing of value behind each dollar, unlike the Gold and Silver that used to be in vaults as the heavier and more cumbersome representation of each more convenient dollar. This value stayed in vaults, while using the easy to carry and exchange paper dollar representing that value instead. The Gold and Silver that used to represent that dollar, I believe is no longer there… that has been spent… disappeared.

It would be like taking your heavy Winter coat into a restaurant, handing it to a check in person, the check in person giving you a ticket that represents your coat, eating and enjoying your meal, then going to leave and presenting the ticket for your coat to that same check in person… but not getting your coat to wear out into the freezing cold… because they’ve sold it. You get a piece of paper that says… “We Owe You.” So, in the case of the coat, you’ll be okay if you don’t leave the restaurant or it’s tolerably cold outside to keep you from freezing.

This is what has happened to the American Dollar over the decades since it was removed from the Gold Standard in 1933. The same happened with Silver coinage. When the value of Silver became greater than the Face Value of the Silver content of Dimes, Quarters and Half-Dollars, the “Coinage Act of 1964/65” changed the content of those American coins to something of similar worth to carnival tokens… clad coins of virtually no value.

I have heard the talk of people who swage (Pressure form) their own lead filled copper bullets discuss using the American penny. Even though it is not all copper, forming it for the full metal jacket outer copper part of the bullet… as they think it would be cheaper than buying sheet copper.

All of this has transpired and rests in the annals of the memories of people long gone before us… the difference being, people now no longer even think of going to the treasury and asking for Gold or Silver for their paper money. That thought has been buried with the people who experienced a time when it was a law of our currency.

Now, the backing of the dollar is only a statement of words. That statement is that the American Dollar is now “Backed by the full faith and credit of the United States Government.” Is that you, them, the Federal bureaucrats, Central Bankers, Treasury Department… who is it that’s promising the “Full Faith and Credit” and of what value is that to you? It is a promise of words… from a government with the reckless and endless spending habits of a drug addict or alcoholic who has by and large defaulted on other promises.

Clay Olson is from a family that has dealt with Precious Metals for generations. Precious Metals has been Clay’s sole focus and occupation for over 40 years. Clay deals only with a network of other bullion dealers that he has dealt with for decades. I was referred to him by a retired Special Forces First Sergeant friend who has also known and dealt with him for years. Established trust.

One of Clay’s first statements to me was… “The majority of the American people have very little understanding of why our money USED TO BE Precious Metal and is now only copper-nickel tokens, empty promises printed on cheap paper or worse, a digital computer printout. There is no interest in teaching our young people about this because that would muddy the water that the government needs to keep perpetually muddied now in order to fool the masses. How sad.”

Weights and Measures of Precious Metals

But first… something to make understanding the different weights and measures of Precious Metals… if it’s confusing, blame your ancestors.

The Gold Karat

Different than the Gold Karat purity system, the Diamond Carat (Carat spelled with a ‘C’ instead of ‘K’) is a weight system for Diamonds. The value of a Diamond considers weight of the Diamond more than anything. Other factors are part of the value of a Diamond such as color and clarity. A metric Carat is defined as 200 milligrams. Each carat is subdivided into 100 points taking into consideration precise measurements to the hundredth of a decimal place. The word ‘Carat’ or ‘Karat’ comes from the Arabic word ‘qiraṭ,’ which means “a measure of weight.”

Gold Karat system definition… a Karat scale is of the purity of Gold, of 24 units being pure Gold. The purity of Gold is measured equal to each ¹/₂₄ part of pure Gold in an alloy. For example… 24 Karat is pure Gold… 18 Karat is 18 Karats of Gold and 6 Karats of other metal alloy in the Gold.

This system is for Gold only… Silver in U. S. minted coins is measured in percentage of purity as stated by the United States Treasury Department for Silver coins they have minted over the last century and Silver weight can also be weight by Troy Ounces.

Anything made of pure Gold deforms fairly easily and Gold ‘rubs off’ items over time when made of pure Gold metal, than of alloyed Gold objects.

Items such as jewelry are prone to breakage if pure Gold. The alloys are melted into the Gold to harden the metal against this deformity, breakage and wear.

Like “Her bracelet is 22 Karat Gold.” It will last longer and keep its form better if it is 22 Karat than if it is pure Gold… 24 Karat.

If you buy an item of 18 Karat Gold… you are buying 75% pure Gold by weight… the other amount of weight is a way less valuable alloy metal or metals. The higher the Karat number… the purer Gold you have.

Percentage of Silver and Gold… Different than Karat is the percentage weight of Silver and Gold coins which is stated in percentage and mostly used to state the purity of Gold and Silver in minted coins.

The Troy Ounce

The following six paragraphs are exacted and shortened from an essay by and courtesy of JAMES CHEN and www.Investopedia.com

In brief, a Troy Ounce is a unit of measure used for weighing Precious Metals that dates back to the Middle Ages. Originally used in Troyes, France, the Troy Ounce is often abbreviated to read “t oz” or “oz t.”

Some historians believe the Troy Ounce had its origins in Roman times. Romans standardized their monetary system using bronze bars that could be broken down into 12 pieces called “uncia” or “ounce,” with each piece weighing around 31.1 grams.

As Europe’s economic importance grew from the 10th century onward, merchants came from all over the world to buy and sell goods by Roman standards. Some believe the merchants of Troyes modeled this new monetary system using the same weights as their Roman ancestors.

The Troy Ounce is a measurement used in weighing Precious Metals. The Troy Ounce is the equivalent of 31.1034768 grams, whereas the Imperial Ounce is the equivalent of 28.349 grams.

A Troy Pound (12 Troy Ounces) is lighter than a standard Pound (14.6 Troy Ounces but by and large no longer used). The Troy Ounce is the only measure of the Troy weighting system that is still used in modern times. It is used in the pricing of metals, such as Gold, platinum, and Silver. The Troy Ounce became the official standard measurement for Gold and Silver in Britain, and the US followed suit.

Troy Ounce vs. the British Imperial Ounce

The Avoirdupois Ounce (which means “goods of weight”) simply referred to as Ounce (oz), is the British Imperial weight system commonly used in the US to measure foods and other items, except Precious Metals. It is the equivalent of 28.349 grams or 437.5 grains. A Troy Ounce is a little heavier, with a gram equivalent of 31.1. The difference (2.751) may be minute for a small quantity, but it can be substantial for large quantities… especially when dealing in Precious Metals.

When the price of Gold is said to be US $1893/ounce, the ounce being referred to is a Troy Ounce, not a standard Avoirdupois Ounce aka Imperial Ounce. Because a Troy Ounce is heavier than an Imperial Ounce, there are 14.6 Troy Ounces… compared to 16 Imperial Ounces… in one British (and American) Imperial Pound weight (Do not confuse ‘Pound’ in weight to the British Pound currency).

This Imperial Pound is also not to be confused with a Troy Pound, which is lighter and is made up of 12 Troy Ounces.

If hyperinflation occurs in America and the Western World while the United States Dollar IS the World’s Reserve Currency, the whole World will suffer and the World will be in uncharted economic territory.If hyperinflation occurs in America when the United States Dollar IS NOT the World’s Reserve Currency America, America and American Standards of Living will be destroyed. Think… America, a Third World Country standard of living when the American Dollar loses its protected status.

Hyperinflation will devastate your existence as much or worse than a war. Hyperinflation destroys countries, people, societies, meaning and morals worse than any war… without one soldier firing a shot or bomb being dropped.

Read… https://civildefensemanual.com/warning-posted-by-capitalist-eric/

Continue on to part two of this article on “Silver.”

Any further questions about Precious Metals can be directed to Clay Olson at… Nixonshock1971@protonmail.com

Other authors, books and resources I recommend for Preparedness and Survival…

Matt Bracken at www.EnemiesForeignAndDomestic.com

Joe Dolio at www.Tactical-Wisdom.com

Christopher Parrett at www.AVOW.com

Fernando Aguirre at https://ferfal.blogspot.com/

Don Shift at https://www.amazon.com/Don-Shift/e/

NC Scout at www.Brushbeater.org

Johnny Paratrooper at https://www.patreon.com/GreenDragonAcademy